Overview

To size an ERISA fidelity bond, you need the plan’s latest year-end total assets. You can pull this figure from the Department of Labor’s eFAST/5500 public search. The fastest path is to search by plan name or by EIN and plan number, then read the Total Plan Assets value in the results grid. The number you want is in the rightmost column and should reflect the most recently filed plan year.

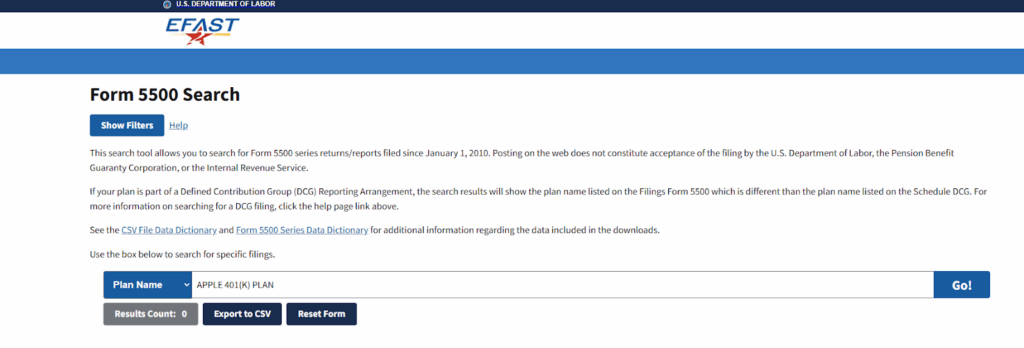

Step 1: Search for your plan

Open the DOL eFAST/5500 Search. Enter your plan name in the Plan Name field. If your name is common, use the employer EIN plus the 3-digit plan number if you have it. Hit Search to load the filings table.

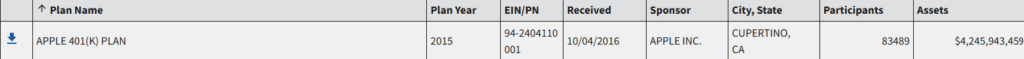

Step 2: Read the results grid

Scan the results table. Each row is a filing year for the plan. Find the row for the most recent plan year. In the rightmost column you will see Total Plan Assets, End of Year. That is the figure you should use for the bond calculation.

Step 3: Confirm the filing year

Look at the plan year end date in the results. Use the latest filed year. If your most recent year is not posted yet, use the prior year. For brand new plans without a filing, rely on the latest trustee or custodian statement until the first 5500 is filed.

Step 4: Drill in if needed

If you want to validate the number, click the filing to open the details. For large plans, you can review Form 5500 and Schedule H. For small plans, you can review Form 5500-SF or Schedule I. In each case, confirm the end-of-year total assets figure aligns with the grid. Save a PDF copy for your plan file.

Special cases

Multiple plans under one sponsor: repeat this process for each plan. Each plan needs its own bond sized to its assets.

Pooled employer plans and MEPs: confirm you are looking at the correct plan level and not an aggregate that does not match your bonding obligation.

Amended filings: if there are original and amended filings for the same year, use the most recent amended record.

Timing lag: filings appear after year end, so the current filing may reflect last plan year. That is normal. Use the most recently filed year.

How this feeds your bond amount

Once you have the Total Plan Assets value, apply the ERISA formula. Minimum is $1,000. Required amount is 10 percent of plan assets. The cap is $500,000, or $1,000,000 if the plan holds employer securities. If 10 percent is less than 1,000 dollars, use $1,000. If 10% exceeds the applicable cap, use the cap. Review annually so coverage keeps pace with assets.

Ready to issue your bond

You can purchase a compliant ERISA bond online in minutes through our portal:

https://hksurety.my.site.com/SelfRegister

Checklist

Identify the correct plan and year

Capture the Total Plan Assets, End of Year from the rightmost column

Apply the 10 percent rule with the minimum and the correct cap

Save a PDF or screenshot in the plan file

Proceed to issue or renew the bond at the required amount

Disclaimer

This material is for general informational purposes only and is not legal, tax, or accounting advice. You should consult qualified counsel or advisors about your specific plan. Coverage requirements, eligibility, pricing, and features depend on the terms of your bond and applicable law. If anything here differs from your bond, plan documents, or governing regulations, rely on those documents. References to plan asset calculations and example amounts are illustrative only and may not fit every plan type. Links and information are accurate as of October 2025. Regulations, agency guidance, forms, websites, and carrier participation can change without notice. Purchasing through our portal is subject to underwriting and the terms and conditions of the issuing surety.